U.S. jobs growth slowed in March, but not enough to stop the Federal Reserve from considering another interest rate hike as the central bank struggles with high inflation.

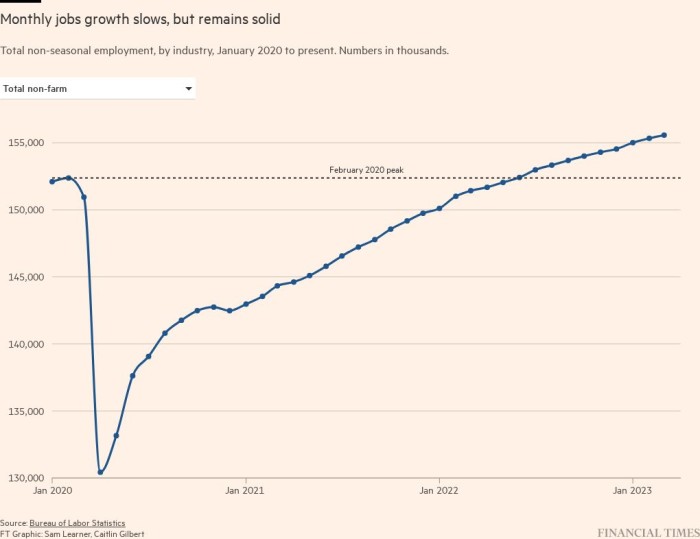

The world’s largest economy added 236,000 positions last month, according to a Bureau of Labor Statistics report released Friday. That was a step down from the 326,000 jobs added in February and well below the 472,000 jobs recorded in January. Most economists polled by Bloomberg had forecast a gain of 230,000 jobs in March.

Over the past six months, monthly job gains have averaged 334,000, according to the BLS.

The unemployment rate fell to 3.5 percent, the lowest in decades. Meanwhile, wage growth was firm, with average hourly earnings up 0.3 percent following a 0.2 percent increase in March.

On an annual basis, wages increased by 4.2 percent. This is the lowest level since mid-2021, indicating that inflationary pressures are easing.

“There are some signs of a gradual weakening of labor demand,” said Eric Winograd, an economist at AllianceBernstein. “We may see some cooling, but we don’t see cooling that will rebalance the economy to reduce inflationary pressures in the short term.”

He added: “The question we’re all wrestling with is whether the turmoil in the banking sector is enough to do that, and it’s too early to tell.”

U.S. government bonds came under selling pressure, with policy-sensitive two-year Treasury yields adding 0.15 percentage points to 3.98 percent in the shortened session. The benchmark 10-year yield rose 0.09 percentage points to 3.39 percent, according to Bloomberg data. Yields rise when prices fall.

US stock markets are closed for Good Friday. Pricing futures markets, investors continue to believe the Fed has implemented its last interest rate hike of the cycle. In a statement released Friday, President Joe Biden said the latest data indicated the U.S. “will continue.”[s] We must face the economic challenges from a position of strength”.

The jobs report this week followed other data that provided tentative signals that the central bank’s year-long effort to rein in inflation is starting to weigh on the historically strong labor market. Jobless claims figures, which track new applicants for jobless assistance, came in higher than expected on Thursday and were part of the BLS’s annual review of the figures, which rose significantly over the past 12 months.

U.S. job openings also fell sharply in February, with Wednesday’s data showing the jobless rate fell to 1.7 from 1.9.

“If I were to assign a theme to this jobs report, it’s clearly on a normal trajectory,” said Christina Hooper, chief global market strategist at Invesco.

“This, to me, points the scale in favor of a very bad central bank going forward.”

Fed officials said that getting inflation back to the central bank’s 2 percent target would require “below-trend growth and some softening in labor market conditions.” Most policymakers, based on forecasts released last month, expected the unemployment rate to rise to 4.5 percent this year and growth to slow to 0.4 percent as they advance their monetary tightening campaign.

The federal funds rate remains between 4.75 and 5 percent, following another quarter-point rate hike last month. Most officials see rates peaking at 5 to 5.25 percent this year and predict no cuts until 2024, with markets waiting for another quarter-point rate hike.

Complicating the Fed’s outlook, however, is the extent of the economic shock caused by the recent banking crisis. Federal Reserve Chairman Jay Powell and other officials said a credit crunch is likely as lenders pull back, but the extent of the layoffs is highly uncertain.

“Such tightening in financial conditions would work in the same direction as rate tightening,” Powell said last month, adding that it could lead to “a rate hike or maybe even more.”

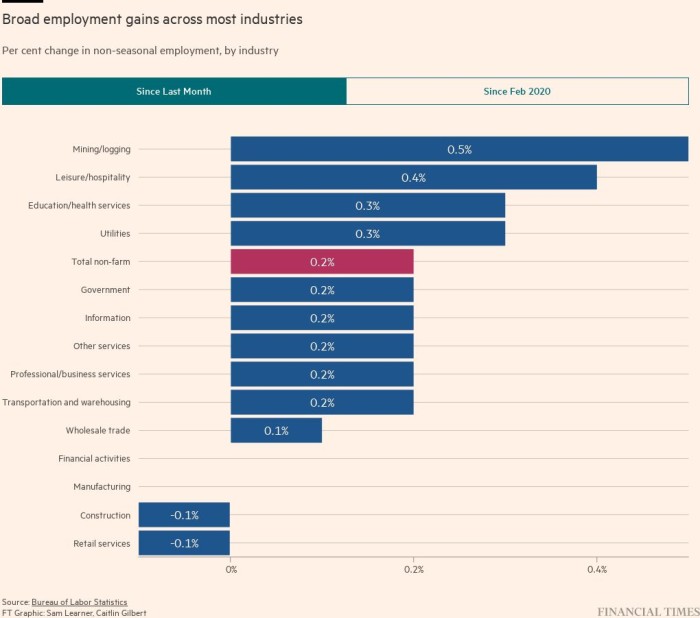

Leisure and hospitality jobs led the gains in March, adding 72,000 positions, according to Friday’s data. That was a step lower than the average monthly gain of 95,000 over the past six months. Government-wide employment rose by 47,000, while professional and business services rose by 39,000.

Among sectors losing jobs, the retail sector had the largest loss at 15,000 positions. Warehousing and storage jobs shrank by 12,000.